Now this is a million dollar question! The Underwriting Analytics performance determines the premiums that you get and hence impacts the business profitability. It’s a fine balance so that you don’t overprice your premiums and become unattractive and at the same time do not underprice and expose yourself to risk. While underwriting quality is important, productivity is also of critical importance. Superior productivity would mean shorter TAT, faster policy issuance and hence increased customer satisfaction.

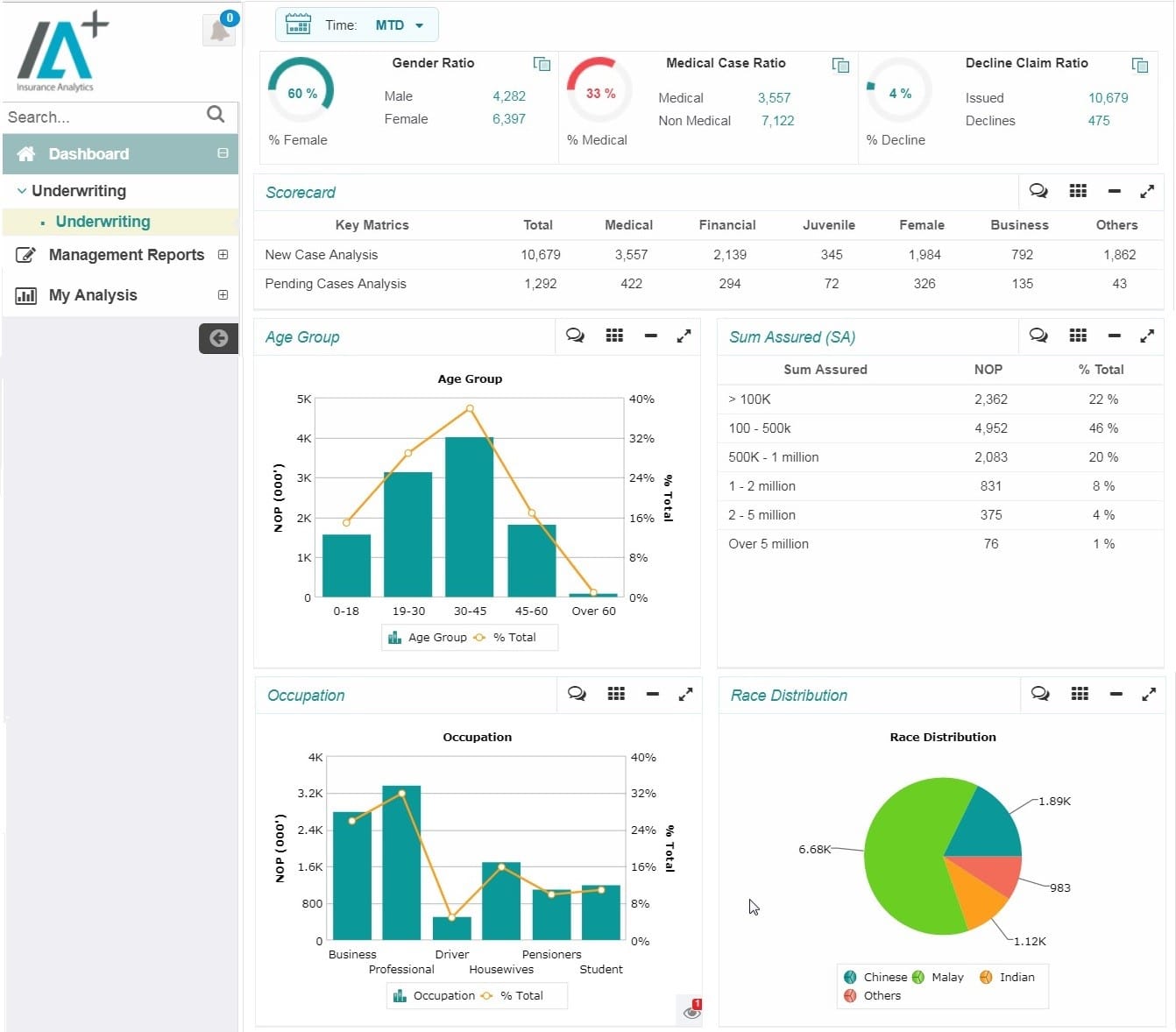

GrayMatter’s Insurance Analytics (IA+) solution provides pre-built, enterprise-wide comprehensive business insights. Underwriting analytics is a separate module in the solution. The module addresses the above objectives of quality and productivity with relevant metrics as follows:

Productivity Measures:

- New cases ( proposal) handled by each underwriter per day

- Average time taken to underwrite medical, non-medical cases, motor, non-motor cases against SLA

- of new cases underwritten by each underwriter per day

Quality Measures the No. of Cases

- Underwritten in 1st attempt

- Referred to senior underwriters

- Referred for review

Performance measures

- Top 10 / bottom 10 underwriters on Productivity measures

- Top 10 / bottom 10 underwriters on quality measures

Get a Demo on Underwriting Insurance Analytics!

To determine insurance risk correctly, underwriters needs to analyze specific risk parameters in relation to claim experiences for each product segment. With the help of IA+ solution, the underwriters can analyze specific risk parameter of new policies, customer portfolio and customer segments before taking decision which can help reduce claim & improve profitability for insurance companies. The predictive model of Insurance Analytics (IA+) provides customer risk scoring so that risk can be estimated before underwriting the policy.